Buying your first home is always a little bit overwhelming, thankfully the team at Abbey&Olivier has carefully put together a list of important ideas and tasks to keep in mind while buying your first home.

First and foremost, you need to have a solid income in order to be able to consistently cover your mortgage payments. Although the majority of home loan durations span 15–30 years, purchasing a property with a mortgage requires a minimum 5-year commitment.

By doing your own research and preparations prior to enlisting the help of a broker, you will be familiar with the real estate market, and your financials, and help you give your broker a clear image of your dream home. The team at Abbey & Olivier will make buying your first home enjoyable and gratifying by using the information you provide and combining it with their vast wealth of knowledge. Here are some tips for ensuring your readiness.

Do The Necessary Calculations

Take a close look at your finances before you start browsing homes on real estate websites. To obtain a realistic idea of what type of mortgage payment you can afford, use your bank statements to help you determine how much your monthly expenditures or analyze your current budget if you have one. Remember to account for extra expenditures associated with home ownership, such as maintenance bills, homeowner’s insurance, real estate taxes, and utilities.

Determine an attainable budget for yourself and stick to it throughout the home-buying process. Banks are frequently eager to pre-approve you for more than you should actually be spending, so best to ere on the side of caution.

Figure Out What Kind of Home You Want

By first understanding the many different kinds of properties that are available, you should analyze all the housing possibilities in your region after you are aware of your financial situation.

- Most people refer to single-family homes when they talk about houses.

- Duplexes: These dwellings generally consist of two residences with independent entrances within a single structure that can share a single wall, if adjacent, a shared floor or ceiling if it is a two-story building.

- Condominiums: These are privately owned apartments located in a larger structure or multi-unit complex, with the interior being owned by buyers such a yourself.

- Townhouses: These are multistory residences that have been built side by side, and the owners are responsible for both the inside and outside. There are often one or two walls that are shared with neighboring apartments, and any shared facilities are covered by association fees.

Create a List of Priorities

Take a moment to draft a list of all the features you want in and around your new home. Ideally discuss these priorities alongside any other affected parties such as your roommate, spouse, or significant other if the situation applies. When you’ve finished drafting your list, determine the prosperity of each item or feature on the list, placing your non-negotiables at the top and more flexible ones at the bottom.

Even with the possibility that you won’t find a home featuring every item on your list, understanding your must-haves before you start your search will ensure you have a certain level of satisfaction. It will also save you time by preventing you from looking at properties that will not ultimately fit your demands.

Your list can start with a brand-new kitchen, a game room, or even a small gym. Everyone has their own special preferences and taking the time to determine yours will ensure your long terms happiness.

Browse Through Listings Online

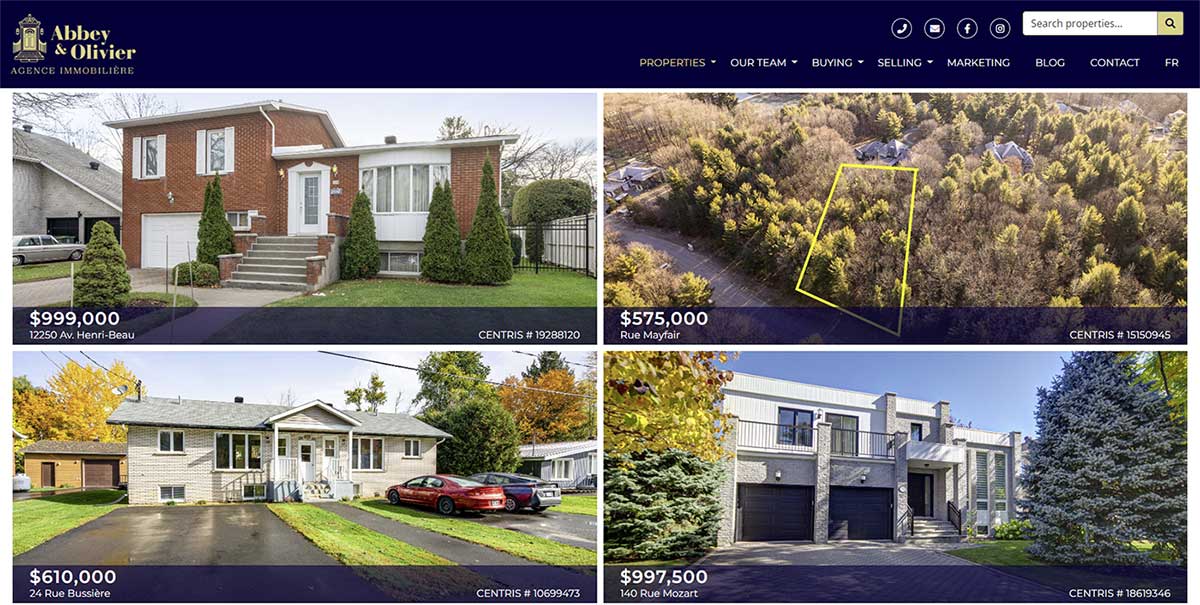

Now that we have all of our finances in order and we’ve already been pre-approved for a loan it’s time to start browsing through listings online. The team at Abbey & Olivier can arrange for you to receive automatic emails with new listings in your search criteria and finding your absolute dream home.

When you’ve completed the aforementioned planning and research, you’ll be in a fantastic position to confidently look for a new property. Along with having your finances in order, you’ll also be well-versed in your neighborhood’s real estate market and have the resources you need (like pre-approval) to submit a compelling offer.

Get Yourself a Fantastic Real Estate Broker

The most crucial component you require when purchasing a home for the first time is a seasoned real estate broker.

You can manage the home-buying process with the help of a smart and confident broker and save yourself time and stress as they guide you. In addition to helping you find the perfect home, a professional real estate broker will go above and beyond with their services using their knowledge of all the ins and outs of a home and will ultimately make your life a lot easier.

If you don’t know where to begin, click here.

Get a Home Inspection

You can look past the appearances, you should never skip the home inspection. While you’re strolling through a property, it may appear normal but could be hiding serious problems that a qualified home inspector will spot and investigate. You don’t want to be stranded in a home that requires major, repair work. The home inspection can also help in your negotiation before closing the deal in order to factor in any reasonable repairs to the final price.